How do you make one million dollars in six months? You might recall the story of Ken O’Brien. Ken did not own a single LLLL domain until he bought Adam Dicker‘s portfolio last May, as discussed in this DomainSherpa episode (11:00 to 19:00). Since then Ken started working with me to learn about the LLLL market and he acquired a thousands more four letter domains. Today Ken owns over 1,400 LLLL .com domains. By entering the market at a time when LLLL were priced considerably lower, he confirmed to have made $1,000,000 in profit.

Few investments in the domain world will make you a 412% ROI in 6 months, with little to no downside and a minimum starting investment of $100. This is how much you would have made if you had bought Chinese Premium LLLL .com domain in March and sold it 3 weeks ago at floor price. Interestingly, LLLL .com domains have grown so much in value that as of today, only 3 weeks later, the 412% has turned into 530%. Too good to be true? Yes. But this happened in front of our eyes and all the signs (and fundamentals, which we will discuss later) were there, and there is still room for LLLLs to grow in the future. I talked about this in my newsletter, Oliver Hoger talked about it on DomainShane and several Namepros threads reported what was happening.

In this guide I will explain how investors like Ken managed to obtain such disproportionate returns, and how you can replicate their success. And our journey starts by looking at the 3 reasons why this category of domains largely outperformed all others in 2015:

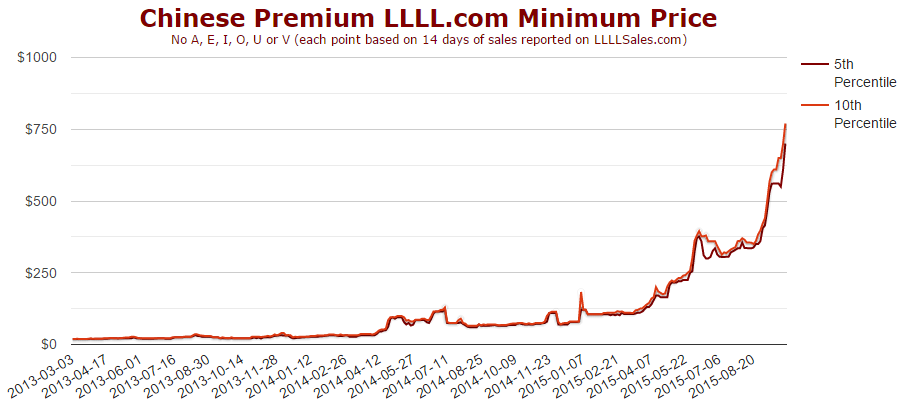

- Chinese Demand. Throughout 2014, LLLLs were considered only marginal assets, and the objects of Chinese demand were exclusively NN, NNN, NNNN, LL, LLL and LN/NL. This changed in early 2015 and Chinese buyers have started to aggressively pursue this category, mass-emailing owners with frequent price requests and unsolicited bids. Within a few prices skyrocketed to form the chart below. Sales executives who project revenues jokingly refer to this shape as the “Hockey Stick” – with the only catch that this is not a projection, but actual market data:

Courtesy of LLLLSales.com

Probably the most shocking event that boosted the category was the sudden registration of 30,000 Chinese Premium LLLL .net domains which we reported a couple of months ago in my newsletter, and Elliot from Domain Investing reported on his blog. The reasoning behind the registration was quite simple: if each LLLL .com with no a,e,i,o,u,v was worth at least $300 at the time, and LLLL .nets were valued at 5-10% of the .com, or $15 to $30, by registering a domain for $8 the buyer assumed to make at least a $7 to $22 profit. What’s more, with the recent price increase the profit per domain actually jumped to $22 to $58.

Even more surprising was the sudden registration of 160,000 Chinese premium four letter .top domains. Just type in any random four letter combination (with no A,E,I,O,U,V) .top and you will notice how they have all been taken. The .top extension is the second gTLD for number of registrations after .xyz and, as ntldstats.com shows, it boasts over 500,000 registrations, or just about 6.84% of all new gTLDs, with the vast majority of domains bought from Chinese registrars.

- LLLLs are affordable. Let’s face it, investing in LL, LLL and NNN .com is a boat that has sailed long ago for most investors. Not everyone can afford a $15,000 minimum investment to get into the game, and even the NNNN are quickly reaching floor evaluations close to $10,000. The low end of these markets is being scouted weekly by investors and brokers alike (riding the big Chinese wave) and good buying opportunities are long gone. However, with prices starting at $100, the LLLL are still accessible to anyone who wants to invest in liquid domain names.

What is even more important is that liquid domains are affordable not just for investors, but also for end users. I have had the privilege to broker both LL.com and LLL.com domains, and while pitching an acronym to a company always gets the management interested, it has become increasingly difficult for them to approve a $50k plus purchase for the ownership of the domain. For example, just a couple of months ago, I found myself explaining to the head of marketing for a large corporation that we had received a $27,000 bid from an investor in China for a three letter .com and therefore their $5,000 bid could not be considered. His reply was: “The seller is crazy not to take it“. Fast forward to another recent exchange with the General Counsel of a large software multinational with offices worldwide: “I spoke with my CEO and we can offer a maximum $50,000 for this domain”, talking about a NL domain that routinely received bids around the $100,000 range from Chinese buyers. This happens quite often – and, if you are involved in this game as a broker or investor you might have noticed how Chinese investors are bidding amounts that end users are rarely willing to match. Think about AV.com that sold from Yahoo to a well-known Chinese investor, or FF.com that recently moved from Bank of America to supposedly yet another Chinese investors. In hindsight, it’s funny to think that a Chinese domain investor might have deeper pockets than Yahoo or Bank Of America. The game until two years ago was relatively simple: buy a domain on the cheap, then flip it to an end user. When the reverse happens, and investors buy from end users, it clearly shows how the game has changed and Chinese buyers see something that large companies don’t.

The good news is that this is not the case for LLLL, and there is a healthy number of end user sales happening for amounts at least 5 to 10 times higher than the investor price. It is easy to explain to an end user how owning their exact match domain is worth at the very least $5,000. This is because, even for a middle manager of a large corporation, it is easy to write off a domain purchase up to $10,000 without requiring board approval or lengthy negotiations.

- Extreme Liquidity. Given their price points, LLLL.coms are extremely liquid, much more than other domain categories. If you look back at the past 12 months, it is hard to find more than 5-10 weekly transactions for LLL, NNN, NNN and the whole lot of 29,576 liquid domains. On the other hand, there is a statistical evidence that there are at last 25 daily sales of LLLL. Remember the definition we use for floor prices? The floor price is the price you can expect to sell your asset for in a relatively short period of time – typically around one or two weeks. Being able to cash out your assets on very short notice makes them much more attractive to hold. Well, for a LLLL, it might take you less than 3 days to sell at floor price. If you don’t believe me, try for yourself: simply list your domain at BIN or set up an auction and see how quickly you manage to sell your domain. The other great advantage of owning LLLLs is that, unlike owning LL or NNN where you can’t really sell shares of your domain if you need some quick cash, you are perfectly able to sell any amount you see fit to replenish your bank account.

Now that we have seen why LLLLs have become so popular, let’s get back to you. How do you profit from this rising tide of LLLL? To borrow from Mr Warren Buffett, there are only two rules when investing in LLLL. The first one is “Do not lose money”. This means: do your own due diligence and make sure you are not overpaying for domains. How about the second rule? Well: “Whenever in doubt, go back to rule #1”. The goal of this guide is to educate you about LLLL so that you will only engage in purchases of domains below market price. Therefore you will know that you are actually making a profit BEFORE buying any. And your first step in investing in LLLL begins with understanding exactly how much they are worth and why. Let’s dive right into it.

What makes an LLLL.com valuable?

- Patterns. Just like for numeric domains, the first driver of value for a LLLL is patterns. But not all patterns are made equal and some patterns hold a value that is 10 times higher than an “unpatterned” domain. Here are the most valuable patterns ranked in order of value:

- AAAA (e.g. pppp.com).

- ABAB, AABB (e.g. koko.com, ccmm.com).

- AAAB, BAAA, ABBA (e.g. bbbr.com, prrr.com, grrg.com).

- AABA, ABAA (e.g. ggrg.wpengine.com, rdrr.com).

- Other pattern combinations.

What does it mean for you? Before buying (or selling) any domain with a pattern, make sure to use one of the tools we recommend below to see how much they sell for. Never rush into an investment decision unless you have sufficient data.

- Initial and Final letters. Tales are told of mini-words influencing the value of a LLLL. You know the ones like Mr, Dr, Pc, Fx and Ez etc? Well this is partially true, and something to take into consideration when dissecting a portfolio of LLLL. This is because it is more likely that an end user buyer might be interested in such domain. The little keyword that I particularly like (since it has shown consistently higher sales prices) is “tv” at the end of the domain, as in cctv.com. One more thing to consider: some combination of letters in Chinese might be the abbreviation of a major city/region (BJ – BeiJing; SH – ShangHai, HK – Hong Kong, ZG – Zhong Guo or China in Mandarin, SZ – ShenZhen) and therefore might command higher valuations when sold to a Chinese buyer.

- Western Quad Premiums. There was a time, not long ago, when the value of a random combination of 4 letters was calculated by how many premium letters composed the domain. And, by definition, the premium letters are all letters of the alphabet excluding J, K, Q, U, V, W, X, Y or Z. Makes sense, right? The theory underneath was pretty simple: premium letters are more common starting letters than non premium letters in English dictionary words, and therefore more valuable. Some sources attribute this theory to some domain investor having an Eureka moment while looking at the letter values while playing Scrabble:

Oh, and just for the Scrabble lovers, here is how the letters rank in the board game:

- (1 point)-A, E, I, O, U, L, N, S, T, R.

- (2 points)-D, G.

- (3 points)-B, C, M, P.

- (4 points)-F, H, V, W, Y.

- (5 points)-K.

- (8 points)- J, X.

- (10 points)-Q, Z.

The theory held true only until the 1st of June 2015, the official date in which the Domain Gods, commonly known as the immutable laws of supply and demand, decided that Western Premium LLLL were less valuable than the so-called Chinese Premium LLLL (or Chips, as Tim Schoon calls them). This was because their floor price was passed by the new Chips buying frenzy. But hold on, what are these Chips again and why did they change everything?

- Chinese Premium (Chips) and Pinyin. V does not stand only for Vendetta, but it also stands as the only consonant that is not a Chinese Premium Letter. By now this should be common knowledge, but for the domain newbies out there, let’s repeat it: in China ALL letters are considered premium with the exception of A,E,I,O,U,V. But (and this is a capital B “But”) this does not mean that Chinese words do not contain vowels, rather the opposite. Let’s look at reasons why, so we can dispel some myths. Remember, every syllable in Mandarin contains at least one vowel, which make syllables pronounceable like any other language in the world. That is why, whenever you see Chinese sounding words selling for hundreds of thousands, like gang.com, it is because the word actually has a meaning in Chinese. So why in the world don’t the Chinese like vowels? The reason is because there are very few syllables in Mandarin that starts with vowels, and therefore any letter combination containing a,e,i,o,u is much less likely to be an acronym. The only exception is the letter V, which simply does not exist in pinyin. One more thing: just because a LLLL is a Chip, does not mean that it necessarily has a meaning in Chinese. I often receive emails from clients saying, “I received a $600 offer to buy kxxj.com, but I am hesitating because kxxj probably has some secret meaning in Shanghainese”. I hate to break your dreams, but kxxj DOES NOT mean anything in Chinese. If you want to dig deeper into Chinese pinyin, I recommend taking a Mandarin course or, at the very least, print this pinyin table to understand which syllables actually are pinyin. With this chart, you will be able to separate a pinyin syllable from a wannabe Chinese word.

- Pronounceable Domains. CVCV, VCVC (where C = consonant and V = vowel) and other pronounceable syllables like XOOX patterns (as in goon.com) have historically fetched higher sales prices, and therefore are considered more valuable. A couple of words of caution though: first, just because a LLLL follows the CVCV structure, does not mean that it actually has the value of a CVCV. For example xoha.com is technically a CVCV, but its value is much lower than a proper CVCV like dupe.com because it is considerably more difficult to pronounce. Secondly, the opposite can also be true. The letter “y”, which is technically a consonant, actually sounds like a vowel, especially if at the end of a word. Therefore cady.com is more valuable than xoha.com. In other words: pronounceability is more important than letter structure.

Armed with all this information, it is time for you to do your homework and find out how much these patterns sell for. The best 3 resources I use to understand the value of LLLLs are:

- Estibot. Seriously, if you don’t use it yet, get an account. Why is it so valuable? Because it allows you to scan up to 10,000 LLLL and check exactly how many extensions have been taken for each LLLL and how many searches there are for your kxxj keyword.

- LLLLSales.com. I simply love this tool. Besides providing the graphs appearing in this guide that show the floor prices, it also allows you to research exactly how much specific patterns like CVCV or ABBA sell for. Priceless.

- Namebio.com. Lovely as LLLLsales, but with a couple more search functions, including searching for a mini keyword or checking the sales for other extensions (e.g. LLLL.net).

How can you invest in LLLL?

Now that we have looked into the factors determining the value of a LLLL, let’s go to our final and most important part – how do you actually make money with them? This is both an art and a science. I will leave you with 3 valuable tips that can nudge you along the right path:

- Look out for buying opportunities. There are about 456,756 LLLL and only 160,000 Chinese premiums. Figure out exactly how much they are worth and then scout the market for good buying opportunities. It is still very possible to make a couple hundred bucks in extra profit by finding underpriced assets and flipping them through auctions, marketplaces and private sales. If you have a bigger budget, I do recommend to purchase a portfolio, as that would give you the biggest opportunity to purchase domains at a discount, while holding off for market appreciation, end user sales, and retail selling. Which brings me to the second point:

- When buying, go where there is less competition. There are some auction websites that have become so popular that there are at least 3 bidders committed to buy every LLLL coming their way. Obviously this is NOT a good place for you to find opportunities because prices are already inflated because of the playing field. You have a much better chance by doing your own research – it does take more time but it pays off in profits. I am sure you have heard the poem by “Follow the road less travelled“. Well, there has never been more fitting advice.

- When selling, go where competition is highest, and transaction fees are lowest. Choosing the wrong platform might cost you 20-30% in average cost increase or profit loss, not factoring in the commission, which goes from up to 15% (or more). When you are selling a portfolio of 1,000 Chinese premiums, a 10% difference amounts to $70k, which could buy you a round trip around the world, which would be the perfect occasion to come visit me in Lisbon:

And with these last 3 tips, we finish this LLLL investment guide. Hope you enjoyed it and hope it can make you a successful domain investor. If you would like to receive my free guides, plus the first chapter of the LLLL.com Domain Investing Ebook, do sign up for my free weekly newsletter. I also offer 1 on 1 consulting sessions to learn the ropes of LLLL.com. And if you are looking to buy or sell a LLLL portfolio, or any high value liquid domain name, shoot me a message in the contact section – we have several buyers looking for fair prices.

About the author.

Giuseppe is the CEO and founder of GGRG.com, a domain brokerage and consulting firm based in Lisbon, Portugal. Giuseppe has worked with clients such as PokerStars, Barracuda Networks and 888.com and holds a Master Degree in International Management and Finance from the Fudan University in Shanghai, China.

5 responses to “Investing in LLLL.com – A Starter Guide”

[…] If you need more evidence of a surge in four letter .com demand, here you go. […]

[…] is a very good LLLL.com investing guide available here, written by the founder of GGRG.com, Giuseppe Grazziano, I highly recommend you to read it if you […]

[…] Re-post with permission from Giuseppe Graziano is the CEO and founder of GGRG.com […]

Hey. very good article. I am getting some inquiries from Chinese people to buy my domain gdpz.com

How much does it worth nowadays?

[…] For a deeper explanation of consonant-vowel combinations or Chinese premium domain, I would advise to look into this LLLL investment guide – click here. […]