Important Disclaimer: The opinions expressed in this article, including those generated by ChatGPT, are not investment advice. Chat GPT's answers are highlighted in gray backround and have been lightly edited to enhance readability. The images of LEGO-like figures used are intended for illustrative purposes only. All trademarks and copyrights are the property of their respective owners. No figures have been harmed while writing this article.

“Hey, how about we go check out the first Ikea in Stockholm?” I suggested. “It’s the quintessential Swedish experience!” Alan enthusiastically responded with a resounding yes. Braden, more reluctantly and after some deliberation, decided to tag along. As a fervent vegan, the prospect of meatballs, Swedish furniture, and cinnamon buns was not exactly top of his list. But he relented:

That is how The Breakfast Club unofficially started.

It was at Nordic Domain Days 2023, one of my favorite European domain conferences, which is nearing its 10th anniversary next year. The three of us—Alan Shiflett, Director of Aftermarket at GoDaddy, and Braden Pollock, a legendary investor—started discussing anything and everything about the aftermarket in a casual and informal setting every morning in the breakfast room of the Clarion Hotel in Stockholm.

The conversations extended into the evenings, while the beautiful nordic light of Sweden in spring shone across the windows overlooking the Stockholm archipelago.

Fast forward to 2024, the Breakfast Club became one of the highlights of the AfterMarket Sessions at Nordic Domain Days, with Alan generously sharing some never-before-released GoDaddy data. And when GoDaddy, the largest registrar in the world, shares data, you’d better pay attention:

So what did we talk about in The Breakfast Club? Amid discussions about private deals, the challenges of domain investors, as well as creating an incredibly cool AI-generated rap theme song for The Breakfast Club – for me, one question lingered in my mind after Stockholm: how does domain investing compare to other types of investments?

For over 8 years, we have been publishing in collaboration with Intelium, Escrow.com and ShortNames.com the Liquid Market Report, a comparative analysis of the performance of Liquid Domains (a subset of domains including 2L, 3L and numeric .com domains), versus other asset classes like Gold, Bitcoins, Real Estate, as well as stocks such as Verisign and GoDaddy.

Yet the challenges of this comparison always seem daunting. Understanding the returns of selling a single domain is easy. But how do you calculate the returns of running a portfolio?

And are the returns of running domain portfolios truly better than real estate, stocks, or cryptocurrencies? Are most domain investors profitable? We know many successful investors who started from scratch. But is their success due to arriving early in the game, or is there a secret to their strategy? For those who started late and succeeded, what are they doing differently?

As the Hitchhiker’s Guide to the Galaxy teaches us (and as you are learning with AI), it is not about the answers but the quality of the questions. Curious about these questions? Read on.

Entry Level – How to Calculate Returns on a Single Domain?

The formula for calculating returns on a single domain is straightforward. According to Domain Academy, you subtract the acquisition price, renewal costs, and any brokerage or platform commission from the sales price. For example, if you purchase a domain for $100, renew it for $10 per year, and sell it after two years for $2,000 with a 10% brokerage fee, your profit calculation would be:

Profit = $2000 – $100 – ($10* 2) – ($200) = $1680

Simple, right? This simplicity makes domain investing attractive, as highlighted by many profitable flips documented on DomainSherpa. If you want to get fancier, you might want to subtract the cost of the time spent handling all the tasks above.

For example, if you value your time at $50/hour and it took you 5 hours to buy the domain from the seller, transfer to the registrar, negotiate the sale, transfer the domain to the buyer, and create an invoice, then you need to subtract $250 ($50 * 5) from the $10,000 profit. But let’s keep it simple.

You buy a domain for $10,000, then 3 years later you sell it for $20,000. That sounds great, right? You effectively doubled your investment, getting a $10,000 profit or 100% ROI in 3 years. Let’s also assume that you did not spend any time on it.

But what if you sold the domain for $20,000 after 10 years rather than 3? Would you be as happy with your investment?

Obviously, you might not be as thrilled as in the first case. This is because of the opportunity cost. Every time you decide to invest in domains, you are also forfeiting to invest capital in other asset classes that might be more profitable and/or less risky. For example, if you had kept $10,000 in an interest-bearing account or a Certificate of Deposit at 5.5% per year, your final amount after 10 years would have been roughly $17,081, while enjoying liquidity with no risk and no work.

But let’s make it easier to understand with a real example. Hennie Groot Lipman, an industry veteran, recently wrote me:

“I bought NL.com a long time ago for 230K euro. Ten years later I put it up for auction and it sold to another domainer for about double the price. Outsiders say: ‘Wow, you made 230K. That’s fantastic!’ I say: ‘I made 7% per year (compounded interest) which is not enough for a risky investment.’”

What if Hennie, instead of buying NL.com had invested the €230,000 in other established and understood investment classes? How well would he have fared? Let’s ask ChatGPT:

PROMPT: “In 2005 someone invests €230k in a domain name. 10 years later he sells it for double the price. Calculate a) the rate of return of this investment, b) compare this rate of return if he had invested in the following asset classes: stocks, bonds real estate, cryptocurrency and commodities and c) calculate the final amount he would have had if he had invested in these other asset classes.”

To address your request, we will:

1. Calculate the rate of return for the domain investment.

2. Compare this rate of return with other asset classes.

3. Calculate the final amount the investor would have had if he had invested in these other asset classes.

1. Rate of Return Calculation for the Domain Investment

a) Domain Investment

– Initial Investment (2005): €230,000

– Final Sale Price (2015): €460,000 (double the initial investment)

– Holding Period: 10 years

The rate of return can be calculated using the Compound Annual Growth Rate (CAGR) formula:

Where:

– Final Value = €460,000

– Initial Value = €230,000

– n = 10 years

So, the rate of return for the domain investment is approximately **7.18% per year**.

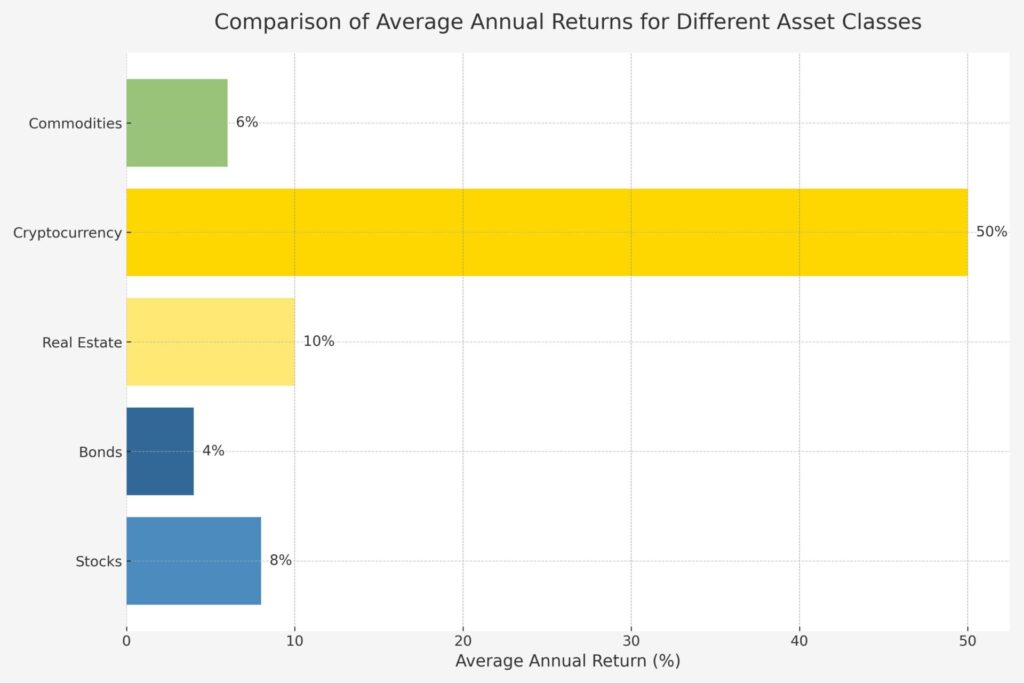

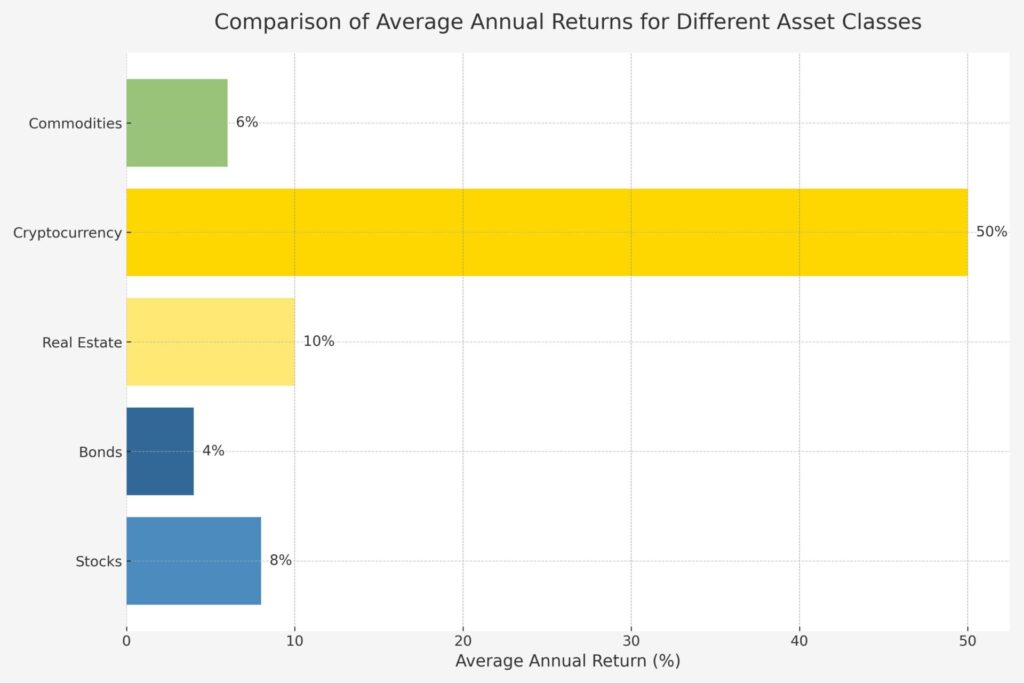

2. Comparison with Other Asset Classes

b) Average Annual Returns for Other Asset Classes

– Stocks: 8% (mid-range estimate)

– Bonds: 4% (mid-range estimate)

– Real Estate: 10% (mid-range estimate)

– Cryptocurrency: 50% (conservative estimate for early cryptocurrencies)

– Commodities: 6% (mid-range estimate)

3. Final Amount Calculation for Other Asset Classes

The future value (FV) for each asset class can be calculated using the formula:

Where:

– PV = €230,000

– r = annual return rate

– n = 10 years

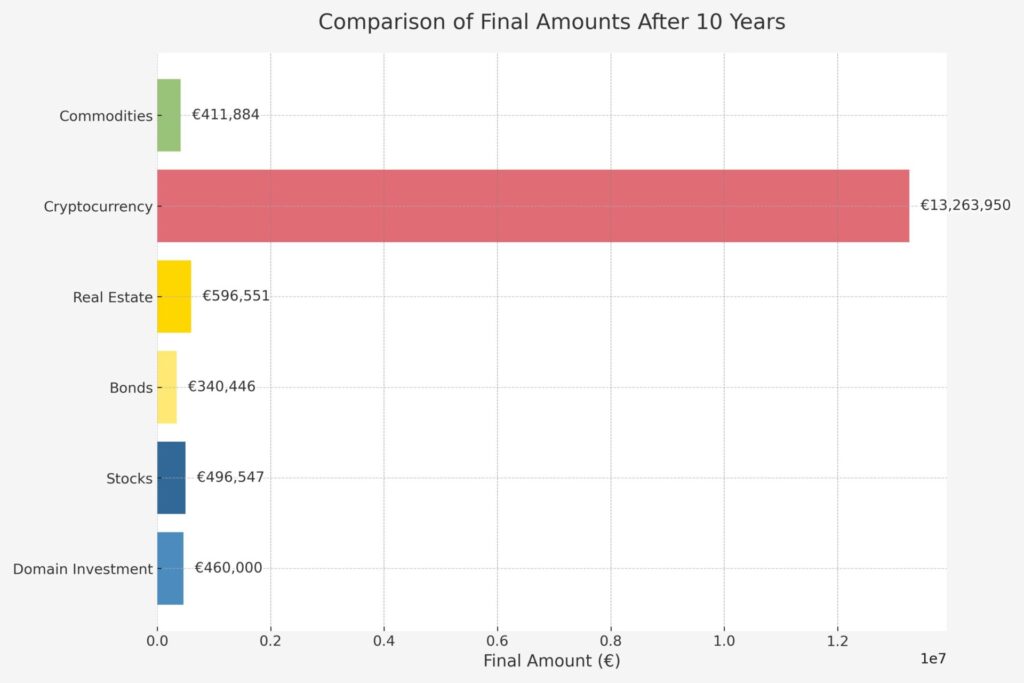

Summary of Final Amounts

1. Domain Investment: €460,000

2. Stocks: €496,547

3. Bonds: €340,446

4. Real Estate: €596,551

5. Cryptocurrency: €13,263,950

6. Commodities: €411,884

If the investor had invested in stocks, bonds, real estate, cryptocurrencies, or commodities instead of a domain name, their final amounts after 10 years would have varied significantly. The most striking difference is with cryptocurrencies, which show an exceptionally high return, albeit with high risk.

Real estate and stocks also perform well, while bonds and commodities offer more modest returns. The domain investment, with a final value of €460,000, falls in the mid-range compared to these other asset classes.

Let’s highlight the final sentence, because it is important:

The domain investment, with a final value of €460,000, falls in the mid-range compared to these other asset classes.

However, while the final numbers highlight only the return on investment (with a lucky run for BTC), they do not stress other factors that might impact your decision. For example:

• Liquidity: If you had invested in stocks or ETFs, your investment would have been almost liquid, meaning you could easily buy and sell without significant delays or price impacts.

• Psychological Reward: Domain names offer a unique psychological reward to investors due to the sense of agency involved. Making a successful domain sale can be more satisfying than passively watching an ETF accumulate value, even if the bottom line is similar.

• Variance: Domain name returns can vary considerably. Depending on your pricing strategy, you might sell to an end user who pays significantly more, effectively multiplying the value of your investment. This is rare, but more on that later.

But, most importantly, we want to bypass the anecdotal evidence of a single domain sale in order to look at the performance of running a domain portfolio as a whole.

As the quote goes: “Statistics are the plural of anecdotes.” Let’s move on to the second step of the analysis.

Intermediate Level – What is the Business of Managing a Domain Portfolio?

After we have calculated returns on a single domain, let’s now try to calculate the return of a whole portfolio.

The answer again seems pretty straightforward. The returns of a domain portfolio are simply the aggregate returns or losses on all the individual domain names.

However, it is crucial here for newcomers to explain one of the most important aspects of domain investing: the difference between end user price and investor price.

In simple terms, the investor price is what investors will pay to resell a domain for profit. The end user price is what a motivated buyer (e.g. a company) will pay to use the domain.

But let’s take even one more step back and start with a deceptively simple and borderline philosophical question:

Besides generating profit for themselves, what purpose do domain investors serve?

Domain names are mostly illiquid assets. If domain investors were not there, most domains would be taken on a first-come, first-served basis, creating several inefficiencies in the market.

For example, let’s imagine it is the start of the internet, and a very entrepreneurial and visionary ice cream parlor owner registers icecream.com. After a few years, Häagen-Dazs contacts the owner and negotiates a significant price to buy the domain. Now, let’s imagine the unlikely scenario in which Häagen-Dazs needs liquidity and wants to sell icecream.com to generate cash. If there were no active community of domain investors, the domain might undersell or become available for registration again, resulting in a significant loss for Häagen-Dazs, which would lose the money spent on icecream.com.

But if there is an ecosystem of active domain investors, Häagen-Dazs could liquidate icecream.com in an auction where several domain investors would compete with each other. The highest bidder would obtain icecream.com and hold it until a new, well-funded ice cream company buys it again.

Essentially, domain investors have business models similar to art galleries, thrift stores, or antique book collectors. Just like an art gallery buys several pictures from famous to lesser-known artists and then displays them for end users to purchase and display in their homes, domain investors are risk bearers. They employ capital to hold inventory they believe has value until they can resell it at a profit to an end user. Unsurprisingly, Fred Mercaldo, the king of geo domains, once traded Andy Warhol artworks before shifting his interest from art to domain names.

However, since most domain names do not hold intrinsic liquid value like icecream.com, in order to operate at a profit, domain investors can’t just resell a domain to an end user for slightly more than they paid for it. This is because most domains, even top-tier ones, might just never sell to an end user.

In fact, industry blogger Keith de Boer reported that one of the biggest money makers in the industry famously said: ‘Most of the domains we own will not sell to an end user in our lifetime.’

Therefore, to cover their inventory bearing costs and hopefully operate at a profit, domain investors need to resell the domains to end users at several multiples over the price paid.

If you have any experience with domain investing, you will certainly agree. In fact, successful domain investors often compare domains to lottery tickets. Here is a quote from Yoni Belousov that perfectly summarizes domain investing:

Even though each domain is unique, there are many other $1,000 domains out there liquidated on the various wholesale marketplaces every day […]. So this means for $8,000 you should be able to find 8 equivalent replacement names. IMO reaching a retail sale on a name is like hitting the lottery. This means that if you take the offer and use the cash to reinvest, you now own 8 lottery tickets instead of 1 and the chance of hitting the retail sale “jackpot” has increased 8 fold. The compounding effect of this strategy means that by the end of a year you’ll end up with hundreds of lottery tickets instead of one. With enough of these “lottery tickets”, you will be winning on a predictable and consistent basis rather than hoping to win with only one ticket.

So how do we make sure that we are “winning enough” to justify the time involved in managing a domain portfolio?

Advanced Level – How to Calculate and Compare the Yield of a Domain Portfolio?

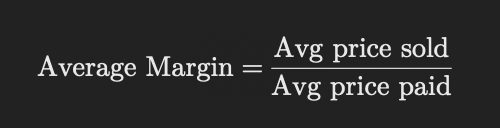

There are 2 main elements required for that. The first one is the Average Margin:

If, on average, you buy domains for $1,000 and resell them for $10,000, you have an average margin of 10x or a 900% ROI.

But unless you are a trader, there is another fundamental piece of the equation that is required to calculating both your yield and how your investment compares to other asset classes, so you can effectively decide the best allocation for your capital.

As Nat Cohen remarked during the burst of the Chinese short domain bubble, ‘A market driven solely by investors is not sustainable.’ Therefore, to create a sustainable plan, you need to determine how many of your domains will sell to end users.

Enter the Sell Through Rate or STR.

The STR is the percentage of domains in your portfolio that in any given year will sell to end users. So, for example if you own 100 domains and you sell 1 per year, you have a 1% STR. Easy.

Now that we understand the Average Margin and the STR, we have all the elements to calculate the yield of your portfolio. However, we need to make 2 important assumptions first:

- Every time you buy a domain, you are buying it at the prevalent investor market price, meaning that you are neither underpaying or overpaying.

- The market value (investor or end user) of your domains does not increase or decrease. You should be able to resell them at the same price in auction to other investors.

While not always accurate—you can underpay or overpay for domains, and their values can fluctuate—both assumptions are on average correct. They are important for simplifying the model and making it easier to understand. But back to the STR.

Let’s assume you have a portfolio of 10,000 domain names, with an average STR of 1%. You purchased all these domains in auctions, with an average acquisition cost of $100 per domain.

Now, you list them on a marketplace and sell them at an average of $2,000 per domain to end users, achieving a 1% sell-through rate per year. Since your portfolio consists of 10,000 domains, at 1%, you are selling 100 domains per year.

Let’s do the math. You have sold 100 domains in one year at $2,000 each, which means you have $200,000 in gross revenue. From this revenue, we need to deduct the acquisition cost (100 * $100 = $10,000) and the renewal costs, which at $10 per domain/year total to $100,000.

To simplify, let’s assume you sell all your domains using a zero-fee platform like Efty.com and buyers are always paying for the escrow fee. Again, the actual profit of your portfolio will be:

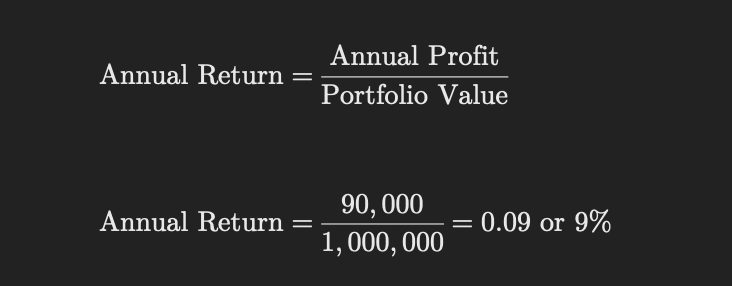

$200,000 – $100,000 – $10,000 = $90,000

Now let’s calculate the yield of your portfolio based on our assumptions. At the liquidation (or investor) price, your portfolio is worth approximately 10,000 domains multiplied by $100 each (the price paid at auction, which we assume you could recover). Therefore, if you liquidate your portfolio through a portfolio sale, its value would be around $1,000,000.

Therefore, your portfolio is a $1,000,000 asset generating $90,000 per year, which amounts to a 9% yield, which is not bad, but might also not be exciting given your alternatives and the time spent.

What if we instead allocated the $1,000,000 in the other previously analyzed asset classes? Let’s ask again Chat G.

PROMPT: If I have a domain portfolio valued at $1M which generates $90,000 per year in profit, should I hold it or reinvest in the other asset classes previously analyzed?

To determine whether you should hold your domain portfolio or reinvest in other asset classes, we need to compare the return on your current portfolio with the potential returns from other investments. Let’s break down the key factors and do some calculations.

Current Domain Portfolio Analysis

– Portfolio Value: $1,000,000

– Annual Profit: $90,000

– Annual Return: 9%

Comparison with Other Asset Classes

Analysis and Recommendations

Stocks – Return: 8% – Comparison: Your domain portfolio’s return of 9% is slightly higher than the average stock market return. Stocks offer liquidity and potential growth but come with market volatility.

Bonds – Return: 4% – Comparison: Bonds provide a lower return compared to your domain portfolio but are much safer and offer fixed income. If you prioritize stability over higher returns, bonds might be appealing.

Real Estate – Return: 10% – Comparison: Real estate offers a slightly higher return than your domain portfolio and provides both rental income and capital appreciation. However, it requires substantial management and maintenance efforts.

Cryptocurrency – Return: 50% – Comparison: Cryptocurrencies offer very high returns but come with significant risk and volatility. If you have a high risk tolerance and are looking for potentially substantial gains, cryptocurrencies might be worth considering.

Commodities – Return: 6% – Comparison: Commodities provide a lower return compared to your domain portfolio and are subject to market fluctuations and geopolitical factors. They offer diversification benefits but may not be as attractive in terms of returns.

Conclusion: Given the current return of your domain portfolio (9%), it compares favorably with most traditional investments except for real estate and cryptocurrencies, which have higher average returns but come with their own sets of challenges and risks.

Recommendations:

1. Hold the Domain Portfolio: If you are satisfied with the 9% return and find the domain business manageable and profitable, holding the portfolio is a reasonable choice. It provides a balance between risk and reward and allows you to continue leveraging your expertise in the domain market.

2. Reinvest in Real Estate: If you are looking for a higher return and have the resources to manage real estate, it could be a good alternative. Real estate offers a return slightly higher than your domain portfolio with the added benefit of tangible assets and potential for appreciation.

3. Diversify with Cryptocurrencies: For high risk tolerance and potential for significant gains, consider allocating a portion of your investment to cryptocurrencies. However, be prepared for high volatility and the possibility of substantial losses.

4. Mix of Investments: Diversifying your investments can spread risk and optimize returns. Consider maintaining a portion in your domain portfolio while gradually investing in real estate and a small allocation to cryptocurrencies.

Ultimately, the decision depends on your risk tolerance, investment goals, and the effort you are willing to put into managing different types of assets.

Conclusion – Models vs Reality.

Obviously, the portfolio analyzed above is fictional. But the example and numbers above are very close to reality. How close? As I was preparing to speak in a panel at Domain Days Dubai, I privately asked a number of successful domain investors about their average margins and sell-through rates.

Almost all the investors shared that their STRs range from a minimum of 0.5% to a maximum of 3%. If you want to dig deeper into industry STRs, there is an excellent article from Bob Hawkes on the matter: Domain Name Sell-Through Rates.

Regarding Average Margins, most domain investors I spoke to reported an average net margin between 5x to 10x. For reference, Braden reported an avg margin between 6x to 8x.

If your portfolio has an average net margin of 7x (or 600%), and an average STR of 1.5% (which are the values reported above), your portfolio yield will be approximately 9% (600% * 1.5%).

I also noted after speaking with Nikul of HyperNames, that lower quality names usually yield higher average margins. It is much easier to sell a $10 new registration for a 200x margin at $2,000 than selling a $50,000 one-word .com for $10 million.

This being said, I have met a handful of very smart people doing spectacularly well with new registrations portfolio. However, it is definitely not easy and I generally would not recommend it. If you cannot achieve a good enough STR, your portfolio becomes an aggregated bundle of $9/year liabilities. I can’t recommend enough NOT trying to build such a portfolio.

The most prevalent and established business model of successful domain investors like Braden is having a small, curated portfolio of no more than 500-1,000 high-quality domains (think one-word, three-letter .coms, etc.) which yields a good average margin and an above-average STR.

The notable benefits are:

a) Your carrying costs are negligible compared to the value of your assets (as opposed to a new registration portfolio, where carrying costs are 100% of the acquisition value of the portfolio).

b) Higher quality domains are more liquid, allowing you to resell them to other investors for more or less the same acquisition price, should you wish to. In contrast, new registrations have practically zero liquidation value.

c) Having fewer domains means spending less time in admin tasks like responding to inquiries, managing renewals, and dealing with the occasional UDRPs. So you can enjoy your life:

In conclusion, domain investing is certainly not easy and it is not a hands-off business if you aim for returns significantly above other asset classes. However, like any other investment class, the numerous success stories remind us that it is possible to do extremely well, given enough focused work.

Understanding the nuances between investor and end user prices, as well as calculating metrics like the Sell Through Rate (STR) and average margin, are crucial for maximizing returns.

If you enjoyed the article, feel free to subscribe to our newsletter and let us know what you learned. As for The Breakfast Club, we might hear more about it in the future. 😉

Special thanks to Russell Panella from ShortNames.com, Logan Flatt at Media Code, Rob from K-Ventures and many other people for the insightful discussions and data shared.

8 responses to “The Breakfast Club – Insights into the Business of Domain Investing”

[…] Source : GGRG Brokerage & Consulting | Read More […]

The collective domain IQ packed into this article is amazing! You’ve such a honed skill for teaching that this blog post felt like a 5 minute read. And frankly this should be required reading for someone looking to get started in the domain investing business. Pure platinum as always GG!!

Well thought out article GG…

Thanks for the insight of others.

I feel there is a learning curve for all investments.

Domains, Real estate, Stocks, Crypto, Futures, etc…

that needs to be factored… in one word: desire.

Thank you.

Ed

Excellent article. Nat’s comment regarding “A market driven solely by investors is not sustainable” reminded me of my Warhol days. After Warhol died, Japan especially invested heavily. After several years, they took their profits, flooded the market with Warhols, and the market became affected and selling prices went down. However, this was temporary. Signed and numbered Warhol prints, and original paintings, are limited….just as super premium .com domain names. Warhol prices eventually recovered, and in the past decades have soared in pricing; I feel the same way about super premium names, 2L.com’s, and pure City or Region geo names. It just takes time, and this article highlights properly the effect of time on ROI. Excellent article Giuseppe, and thank you for mentioning me. Fred.

[…] morning, Giuseppe Graziano of domain brokerage GGRG published an analysis of domain name investing that I think all domain investors should […]

You forgot to add the hours/costs in the portfolio yield calculation. If you take the same costs as from te single domain example this would at 100 * $250=$25,000. This brings te profit down to 65k and the anual return to 6.5%

Hi Ivo, that is correct. One further clarification: neither of the alternative investments presented are completely passive. For example, real estate can require significant management time, and domain names can also be quite time-intensive. The actual time investment also depends on the specific circumstances of the domain sale and the value the investor places on their time, which is subjective.

You did include buying 100 domains per year for $100 each. That is two domains a week that will probably take quite some time.

I would argue that domain investing (with buying domains on a regular basis) requires by far the most management time.